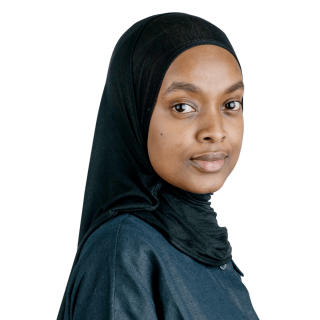

Effective I July 2012, amendments to the EU Prospectus Directive mean a broadening of the circumstances in which issuers of securities will be obliged to produce prospectuses disclosing investment information. Miah Ramanathan reports on a change that significantly increases the burdens on issuers.

Topic: Financial services

Who: The European Parliament and Council

Where: The European Union

When: 1 July 2012

Law stated as at: 26 June 2012

What happened:

In order to offer securities to the public in the European Economic Area (EEA) or trade securities on an EEA regulated market, a UK issuer must produce an FSA-approved prospectus setting out the information an investor would need to make an assessment of the nature and risks of the securities before investing.

The production of a prospectus compliant with the Prospectus Rules published by the UK Listing Authority can be a time-consuming and expensive burden on an issuer and as such there are a number of exemptions available under the Prospectus Directive (Directive 2003/71/EC) (the "Prospectus Directive") which enable issuers to offer securities to the public without producing a prospectus.

However, the exemptions available to issuers have now been narrowed by Directive 2010/71/EU which was implemented into UK law through the Prospectus Regulations 2012 on 1 July 2012 (the "Prospectus Regulations").

The Prospectus Rules

A prospectus serves the purpose of providing potential investors with key information on the securities being offered to them to enable them to understand the nature of, and the risks associated with, the securities on offer and to make an informed decision when investing.

A prospectus will include details of: the risk factors; financial statements; the issuer's company, group and management; any potential conflicts of interest; profit forecasts; principal investments made, and to be made, by the issuer; and the securities and any underwriting arrangements. It is the process of capturing this information and setting it out in an acceptable format that can be time consuming and expensive.

Once an issuer produces a prospectus they will be subject to an ongoing disclosure obligation as well as be liable to the investor for the contents of the prospectus. Hence in one fell swoop an issuer becomes subject to increased costs and liability should it decide to raise capital by issuing securities to retailer investors.

The impact of the Prospectus Regulations on the exemptions

Exemptions for offers of securities with a minimum denomination per unit of EUR 100,000

The Prospectus Regulations raise the threshold such that issuers seeking to take advantage of this exemption will now need to offer securities of a minimum denomination per unit of EUR 100,000 as opposed to the previous position of EUR 50,000.

Exemptions for offers of securities for a minimum consideration per investor of EUR 100,000

The Prospectus Regulations raise the threshold for the exemption for offers of securities for a minimum consideration per investor from EUR 50,000 to EUR 100,000.

The rationale for raising the thresholds

The European Parliament and Council raised the thresholds as they were of the view that retail investors were commonly investing in securities of higher denomination unit values and that the EUR 50,000 threshold no longer distinguished between the investment capacity of retail investors and professional investors.

Why this matters:

It is questionable whether the European Parliament and Council's objective of "reducing the burdens weighing on companies within the European Union to the necessary minimum without compromising the protection of investors and the proper functioning of the securities markets" is achieved when fewer issuers will be able to take advantage of the exemptions and bypass the arguably prohibitive cost of producing and maintaining a prospectus.

In practice the increase in these thresholds will mean issuers are forced either into issuing securities of a higher minimum denomination unit or engaging in transactions of a higher minimum consideration in order to take advantage of the exemptions. Clearly the spirit behind these amendments is to protect retail investors who make high value investments however, it remains to be seen if raising the thresholds tips the balance and is in fact counterproductive to issuers and also investors who are in the business of buying securities from issuers and splitting these off for onwards sale to other investors.